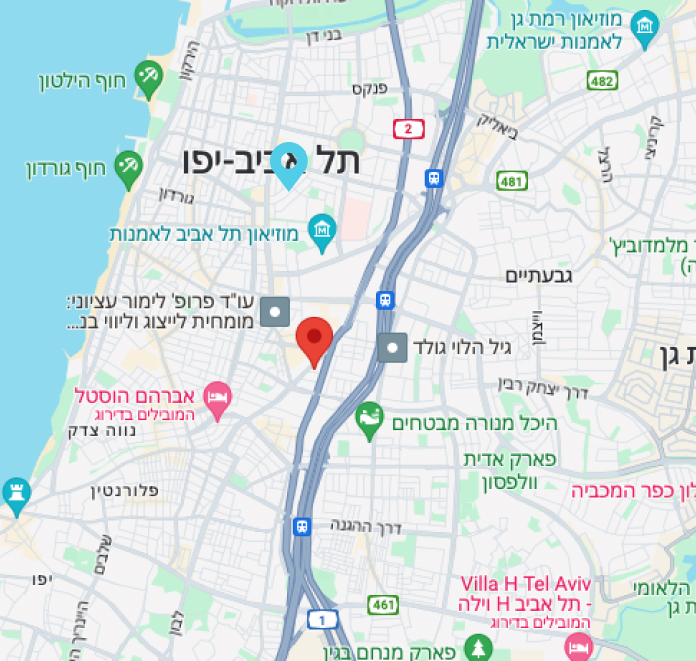

International Taxation

We have a proven track record and experience in constructing complex international tax structures and ventures, supported by our in-depth knowledge, and understanding of the vast array of international tax treaties, different foreign tax systems and familiarity with the frequent changes and updates in these worlds.

We advise and assist in a diverse range of matters, amongst others:

- Optimal tax planning using tax treaties for the prevention of double taxation.

- Withholding tax at source for foreign residents and corporations.

- Residency, relocation of center of life abroad.

- Relocation of corporations – change of corporate residency.

- Tax benefits for returning residents and new immigrants.

- International transfer pricing.

In all these and more, we represent before the tax authorities, through the various stages of tax assessment proceedings and agreements, obtaining tax pre-rulings, approvals, permits, exemptions, etc.

We developed and nurtured excellent work relations with firms and colleagues abroad, and, with their assistance, we enable our clients to conduct vast business operations and activities outside of Israel, knowing with confidence, that the tax front of their operations is protected abroad by top-notch professionals.

The Legal Team

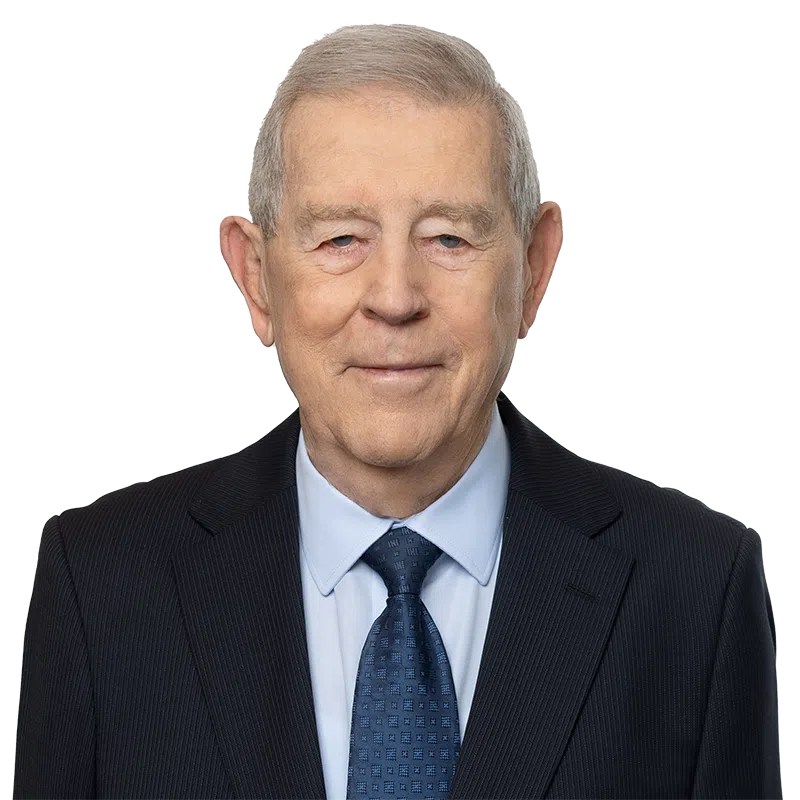

Dr. Moshe Druker

Founding Partner

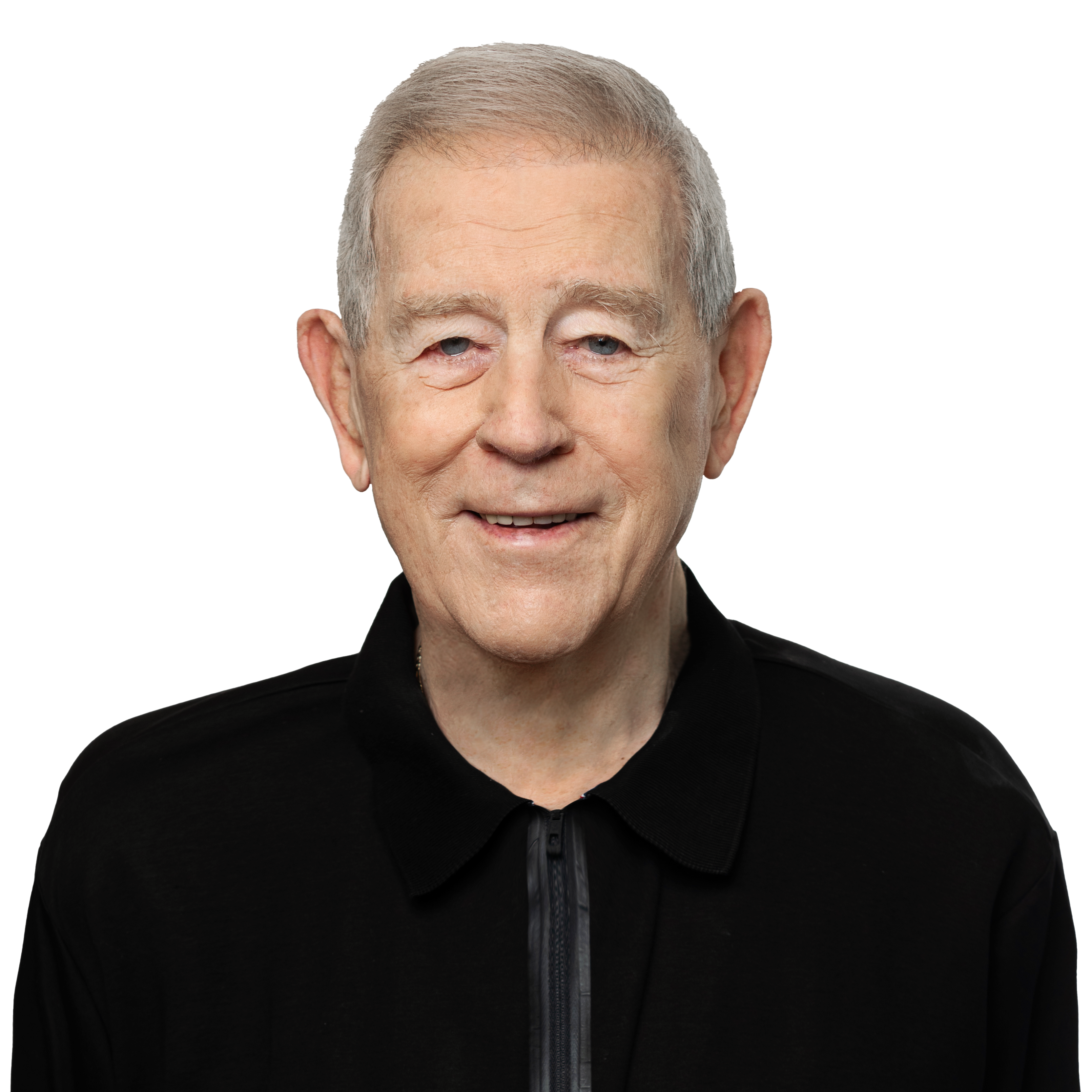

Ori Druker

Managing Partner

Miki Mikaelovitz

Partner

Omer Druker

Associate

Arie Elgard

Associate

Join the newsletter

"*" indicates required fields