Income Tax

Income Tax - touches upon each and every one of us. Under the broad umbrella of income tax we advise and handle, amongst others, on the following:

- Taxation of corporations and partnerships, including form of incorporation.

- Taxation of individuals.

- Tax planning.

- Structural changes (e.g., mergers, splits, spin-offs, tender offers, holdings changes, interested party/controlling shareholders’ transactions, etc.).

- Hi-tech taxation, including incentive plans.

- Utilization of incentives, grants, tax benefits, exemptions, and tax deferrals, under the diverse range of relevant legislation, including the Encouragement of Research and Development Law, 1984 and other encouragement laws.

- Taxation of digital currencies and alternative assets.

- Taxation of voluntary and social-civic sector organizations (non-profits), public-benefit companies and, public institutions.

We meticulously review and examine the business activity to provide optimal tax planning supported by a professional opinion. When necessary, we work vis-à-vis the tax authorities to obtain tax pre-rulings, prepare and file reports, represent through the various stages of tax assessment proceedings and appeals, and before all judicial instances including the Supreme Court.

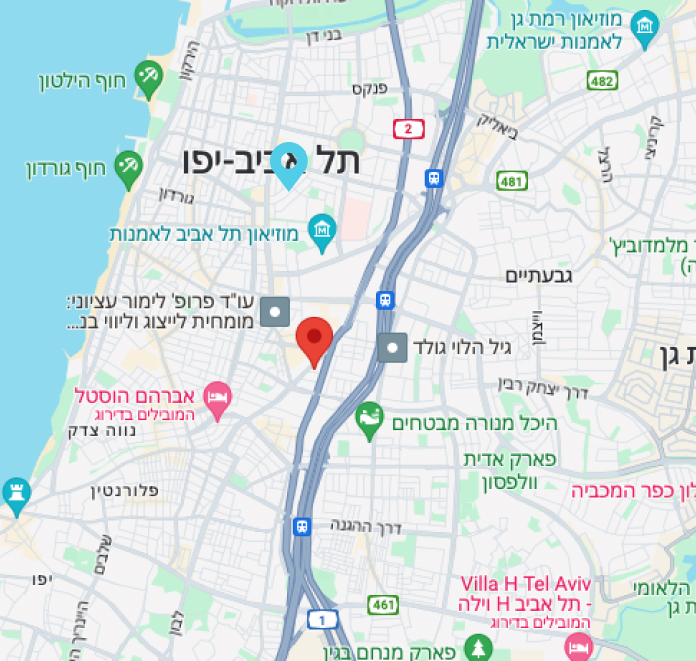

The Legal Team

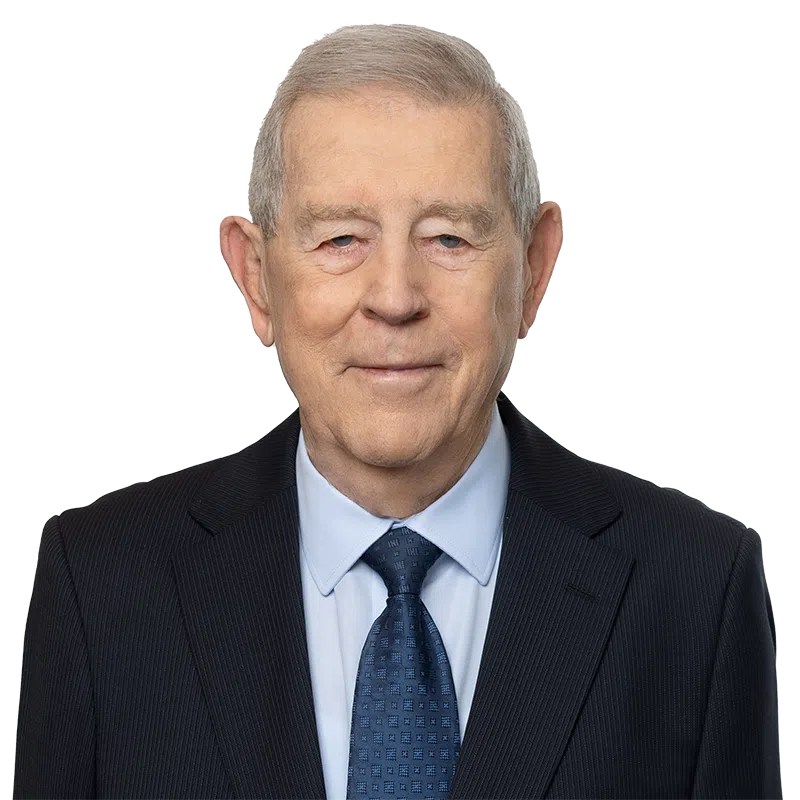

Dr. Moshe Druker

Founding Partner

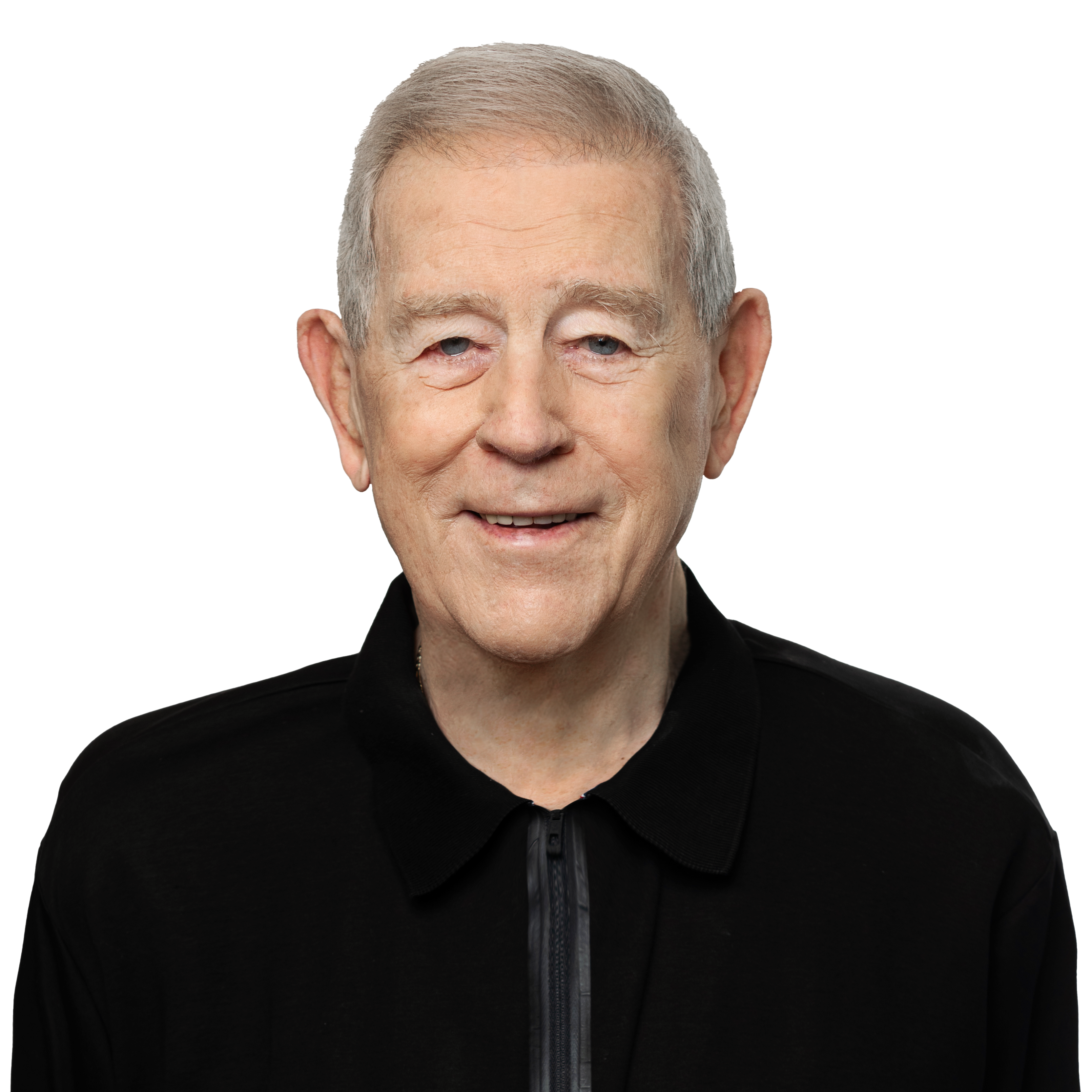

Ori Druker

Managing Partner

Eyal Tzidkiyahu

Partner

Miki Mikaelovitz

Partner

Israel Mandel

Partner

Omer Druker

Associate

Arie Elgard

Associate

Experience, Teamwork, Success.

Join the newsletter

"*" indicates required fields